Mobile App Design

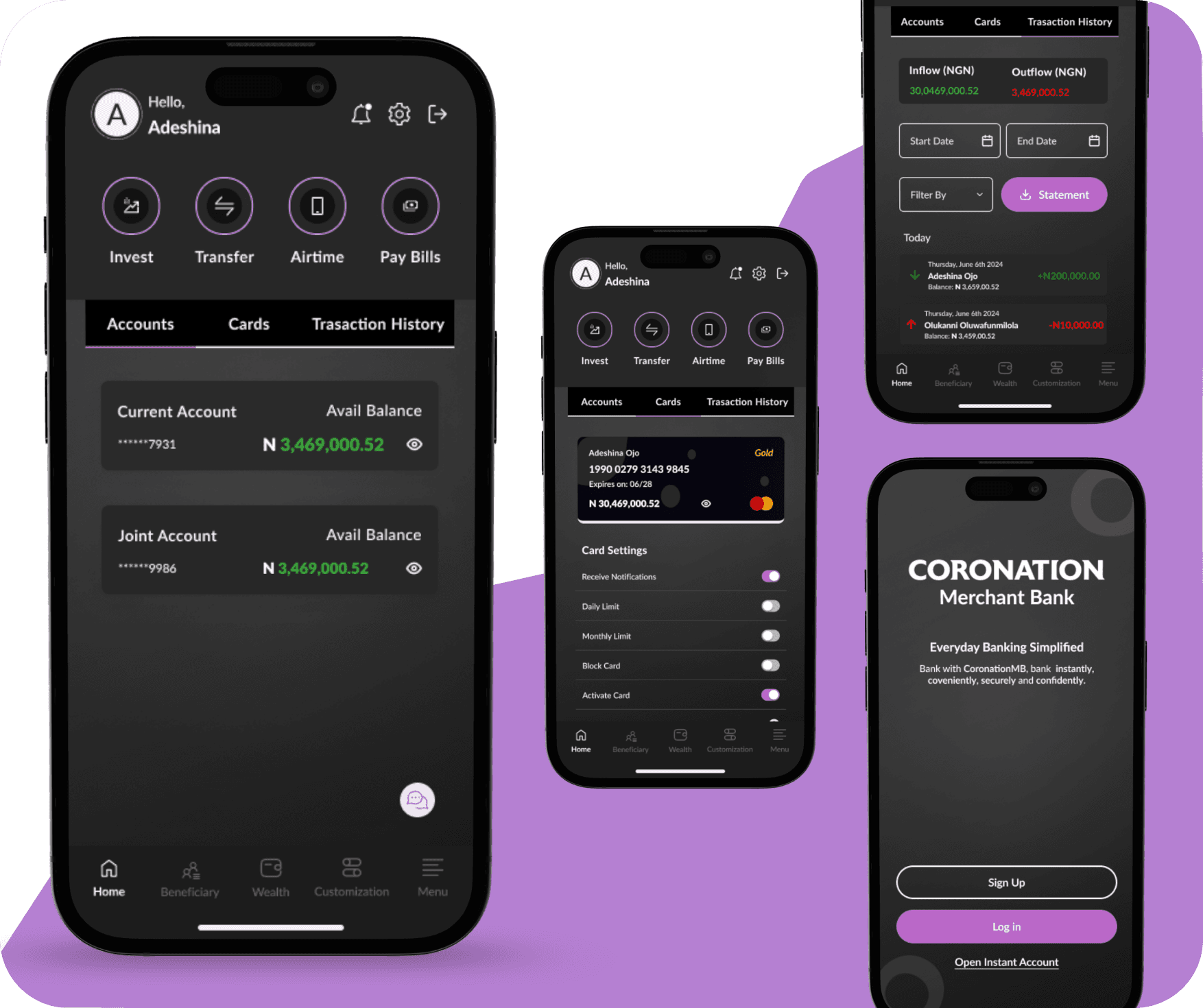

The existing Coronation Wealth app and Coronation Merchant Bank mobile banking app operated as separate entities, creating a fragmented user experience. Users had to switch between the two apps to manage both their banking and wealth, leading to inefficiency and frustration. Based on user feedback and app reviews, we hypothesized that integrating CoronationMB’s mobile banking features into the Coronation Wealth app would provide a seamless user experience and improve customer satisfaction.

To redesign the mobile app to offer users seamless access to CoronationMB mobile banking features, providing a unified platform that allows users to manage their finances and wealth with ease and convenience. This ensures a streamlined and efficient banking experience directly from the Coronation Wealth app.

My Role:

I was the UX/UI designer and frontend developer on a cross-functional team, which included:

> 3 developers (back-end and mobile)

> Project manager

> Quality assurance engineer

> Marketing and communication specialists

Collaboration:

> I was the lead UX/UI designer on a cross-functional team, which included:

> Worked closely with developers to ensure the technical feasibility of the integration.

> Partnered with the project manager to align the app redesign with business goals.

> Collaborated with the QA engineer for extensive user testing and feedback incorporation.

> Cooperated with marketing to develop user guides and communication strategies to promote the app's new features.

The project began with recognizing a significant gap in our service offerings. Users of the Coronation Wealth app expressed frustration over the need to switch between the CoronationMB mobile banking app and the wealth management app to manage their finances effectively. This disjointed experience led to inefficiencies and decreased user satisfaction.

Stakeholders were identified through a comprehensive mapping process:

Coronation Wealth app users, Coronation Merchant Bank customers

Coronation Merchant Bank management, IT and development teams, customer service representatives

Marketing and communications teams, external partners involved in app development

Gathering Information

I embarked on a detailed research phase to gather critical information and insights, which included:

> Conducting user surveys and interviews to understand frustrations with switching between apps.

> Analyzing competitors’ solutions for integrating banking and wealth management functionalities.

> Running usability tests that revealed users wanted a unified dashboard to view both banking and wealth data, with seamless navigation between the two functions.

> Studying industry reports and trends to ensure our solution would be forward-thinking and aligned with future demands.

Identified User Needs

These identified user needs below, guided the design and development of the integrated app, ensuring that the solution aligned with user expectations for a convenient, secure, and efficient financial management experience

> Seamless platform integration.

> Unified financial dashboard.

> Single Sign-On and account creation for convenience and security.

> Easy-to-navigate interface.

> Robust security features.

> Personalized financial insights.

> Cross-platform optimization and performance.

Identified Business Needs

To achieve business objectives through the integration of Coronation Merchant Bank (CoronationMB) mobile banking features into the Coronation Wealth app, several key business needs were identified. These needs focused on improving customer satisfaction, increasing engagement, and driving growth for Coronation Merchant Bank.

> Boost customer engagement and retention.

> Maximize cross-selling and upselling opportunities.

> Achieve operational efficiency and cost savings.

> Improve customer satisfaction and brand loyalty.

> Enhance security and ensure regulatory compliance.

> Expand digital service offerings.

> Develop a scalable platform for future growth.

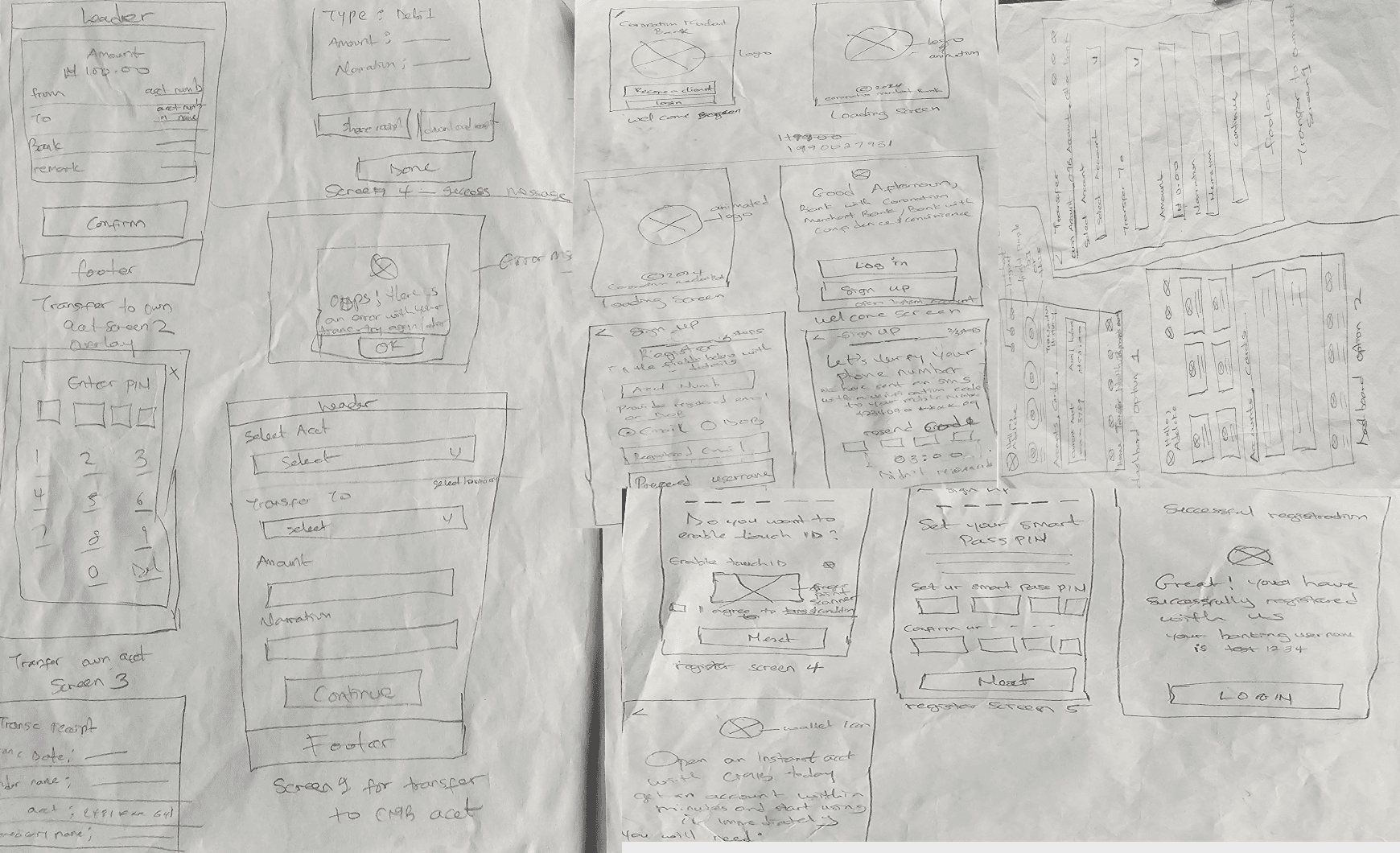

Ideation: Proposing a Solution

Based on our research, we proposed integrating CoronationMB mobile banking features directly into the Coronation Wealth app. This solution aimed to create a seamless, unified platform for users to manage both their banking and wealth needs without switching between apps.

Key features of the proposed solution included:

Unified App

Providing a consolidated view of users' financial and investment portfolios.

Single Sign-On (SSO)

Allowing users to access both banking and wealth management services with one login.

Single Account Creation

Allowing users to create a single consolidated profile with one account setup.

Enhanced Security

Implementing robust security measures to protect user data and ensure compliance with banking regulations.

Personalized User Experience

Offering tailored recommendations and insights based on users' financial behavior and goals.

Simplified Navigation

to make switching between banking and wealth management features intuitive.

Card Management

providing users with comprehensive control over their debit or credit cards, ensuring a seamless and secure banking experience.

Expand Functionality

enhancing the app's overall functionality and user experience

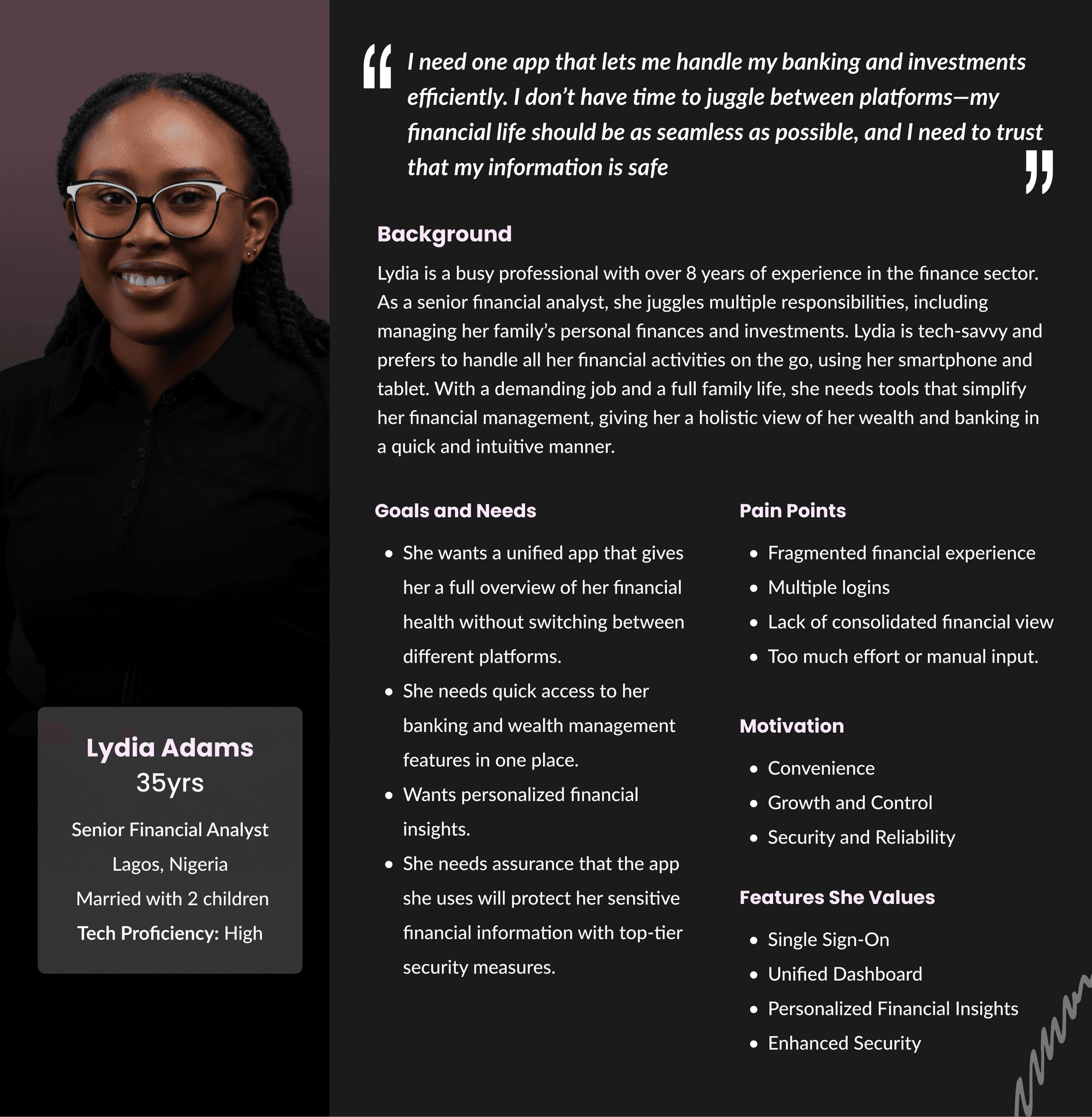

Lydia Adams is a tech-savvy, time-conscious financial professional who values efficiency, security, and a unified approach to managing her finances. She seeks a digital solution that consolidates her banking and wealth management, helping her stay in control of her financial future while saving her time and effort. By addressing Lydia’s pain points and needs, the Coronation Wealth app integration will enhance her financial management experience, improving both her satisfaction and engagement with Coronation Merchant Bank’s services.

The profile above is crafted from thorough demographic research, identifying not only basic characteristics but also the motivations, interests, fundamental needs, and challenges faced by the majority of Coronation Merchant Bank customers.

The information architecture (IA) for the integrated Coronation Merchant Bank and Coronation Wealth app needs to be designed for easy navigation, seamless access to banking and wealth management features, and personalized user interactions. Below is an outline of the key components and their relationships within the app's structure.

This information architecture above ensures that users can access both banking and wealth services seamlessly, with intuitive navigation and a cohesive experience, helping them manage their finances more efficiently and securely.

These designs enable users to personalize their experience through themes, shortcuts, and customizable dashboards

Success Metrics

After implementing the integration, we conducted additional usability tests:

Challenges

> Integrating two complex systems while maintaining app performance required close collaboration with the development team. We had to optimize the app’s performance to ensure fast loading times for the unified dashboard.

> Initially, some users found it challenging to navigate the new system. We addressed this with in-app tutorials and a customer support campaign.

Impact on Users

> The integration significantly improved user satisfaction, with a 30% increase in positive app reviews.

> Users appreciated the convenience of managing both banking and wealth in one place, which improved their overall financial management experience.

Impact on Business

> The improved user experience led to higher customer retention rates for Coronation Merchant Bank.

> Users spent more time within the app, engaging with both banking and wealth services.

>By simplifying the user journey, we saw an uptick in service usage, leading to increased transaction volume and cross-selling opportunities.

Key Takeaways

> Continuous user feedback and testing throughout the design process allowed us to create a solution that directly addressed user pain points.

>Iterating on early design concepts, such as the pop-up dashboard, through prototype testing saved us time and development effort by identifying potential problems early on.

> Close collaboration across teams ensured that we not only met technical requirements but also delivered a solution that aligned with both business and user needs.

In Conclusion, the redesign of Coronation Merchant Bank's mobile app successfully provided a world-class user experience, improved functionality, enhanced security, and better served its customers. The success metrics showed a significant increase in user engagement, positive customer feedback, and a reduction in support requests. The integration of the app into the Coronation Wealth ecosystem further streamlined banking services, solidifying Coronation Merchant Bank's reputation as a leader in digital banking innovation in Africa.