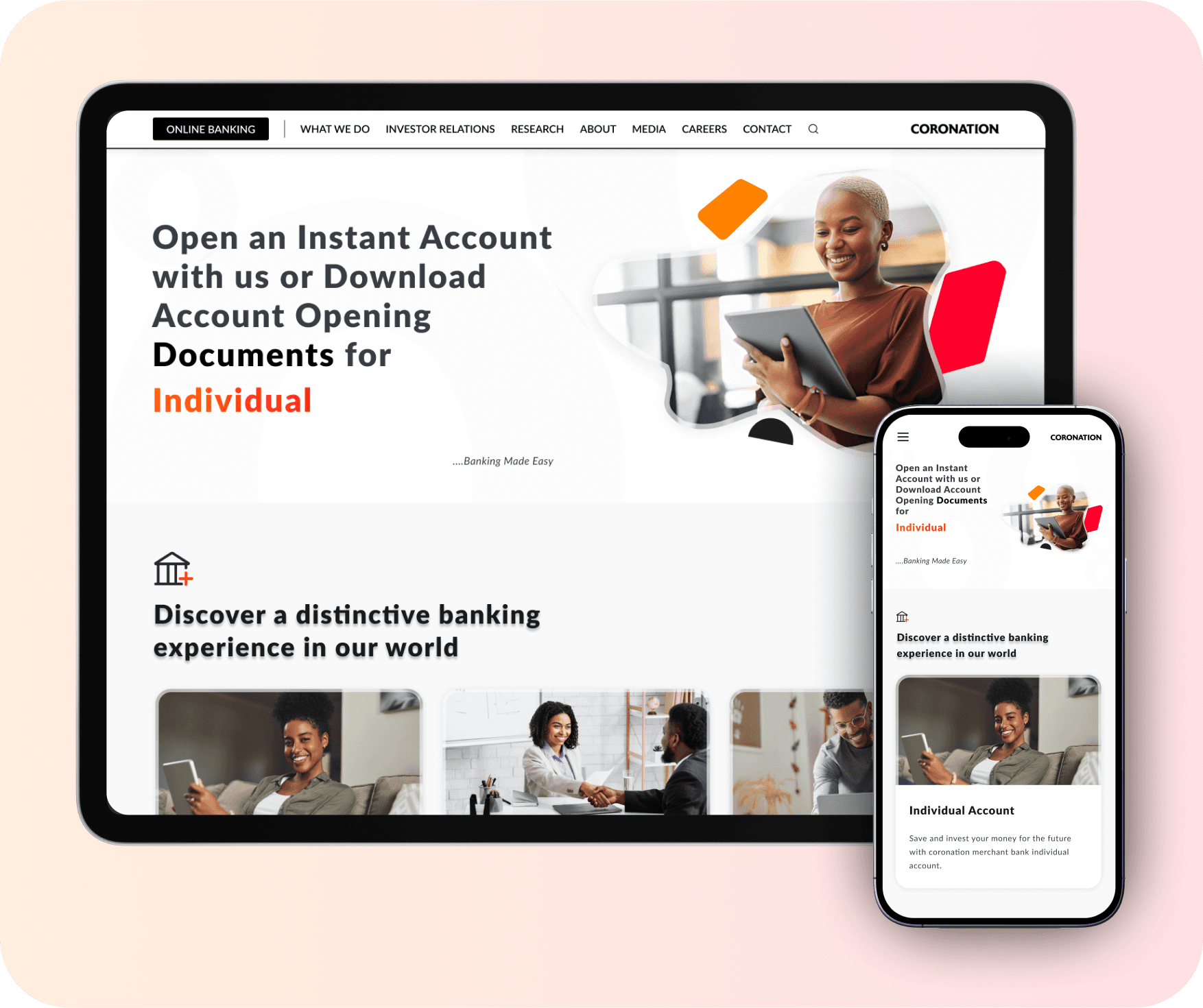

Responsive Website Design

The project aimed to automate the account opening process on Coronation Merchant Bank’s (CoronationMB) corporate website to offer customers a faster, simpler, and more secure way to open an account. Previously, the manual account opening process involved tedious paperwork, delays in verification, and potential human errors.

The goal was to streamline this process by enabling users to open accounts instantly online, integrating verification checks, and reducing the time and effort required by both customers and bank staff.

The hypothesis was that customers were deterred from opening accounts due to the complex nature of the current process, leading to high drop-off rates on the website. Our hypothesis was that by automating and simplifying the account opening process, user engagement and account conversion rates would improve significantly.

My Role:

I was the UX/UI designer and frontend developer, responsible for designing the user interface and experience and developing the frontend of the card manager automation system.

Team Collaboration:

I worked with a cross-functional Agile team, which included:

> 3 backend developers

> Marketing and communication specialists

> A quality assurance engineer, who tested and ensured the product worked as intended.

I was responsible for designing the entire user journey, from ideation to final interface and also developing the user interface. I worked closely with the product owner to align user experience with business goals and collaborated with developers to ensure the

The project began with a simple observation: opening a new account at Coronation Merchant Bank (CoronationMB) was a manual tedious paperwork. Customers had to fill out multiple forms, submit documentation, and make physical trips to branches. The process could take days, leading to dissatisfaction among customers and inefficiencies for bank staff.

The stakeholders affected by this issue were clear. On one hand, customers, particularly corporate and high-net-worth individuals, wanted a faster and smoother experience. On the other hand, the bank’s operations and compliance teams were overwhelmed by paperwork, manual verifications, and back-and-forth communications with clients. This inefficiency also meant delayed revenue generation for the bank.

Stakeholders were identified through a comprehensive mapping process:

Coronation Merchant Bank corporate customers and high-net-worth individuals

Coronation Merchant Bank management, IT and development teams, customer service representatives and customer experience team

Marketing and communications teams, Business analyst

Gathering Information

To begin, collaborating with the customer experience team, we conducted extensive research to understand the needs of both internal and external stakeholders. This included:

> Surveys were sent to recent and potential clients to identify their frustrations. The feedback was clear: they wanted faster onboarding with fewer steps. They also expressed concern about the security of personal information in an online process.

> Meetings with the bank’s operations, compliance, and IT teams were critical to understand the technical limitations and regulatory requirements. Compliance stressed the importance of Know Your Customer (KYC) regulations, while IT highlighted the need for secure, scalable infrastructure.

> We analyzed other banks that had successfully implemented instant account-opening solutions. This helped us identify best practices and avoid potential pitfalls.

> And finally we explored various solutions for automating identity verification (e.g., through government databases and third-party services) and for ensuring a smooth, secure user experience.

Identified User Needs

These identified user needs below, guided the design and development of the app, ensuring that the solution aligned with user expectations for a convenient, secure, and efficient financial management experience

> Customers, particularly corporate and high-net-worth individuals, desired a streamlined account-opening process that could be completed online without visiting a physical branch.

> Users wanted a simple, user-friendly interface to guide them through the process, with minimal paperwork and quick document uploads.

> Clients expressed concerns about the security of their personal data in an online process, requiring robust encryption and data protection measures.

Identified Business Needs

> CoronationMB needed to reduce the manual workload on operations and compliance teams by automating account verification processes, such as KYC and AML checks.

> The bank aimed to improve the overall customer experience by providing a faster, more efficient account-opening solution that would enhance customer loyalty and attract new clients.

> Ensuring that the automation adhered to KYC and AML regulations was critical for the bank to avoid legal risks while streamlining the process.

> Faster onboarding meant quicker activation of new accounts, allowing the bank to generate revenue more swiftly from new clients.

Ideation: Proposing a Solution

After gathering all the data, we proposed an automated, step-by-step online account opening process that could be accessed through CoronationMB's corporate website. The key features included:

Key features of the proposed solution included:

Instant Account Opening

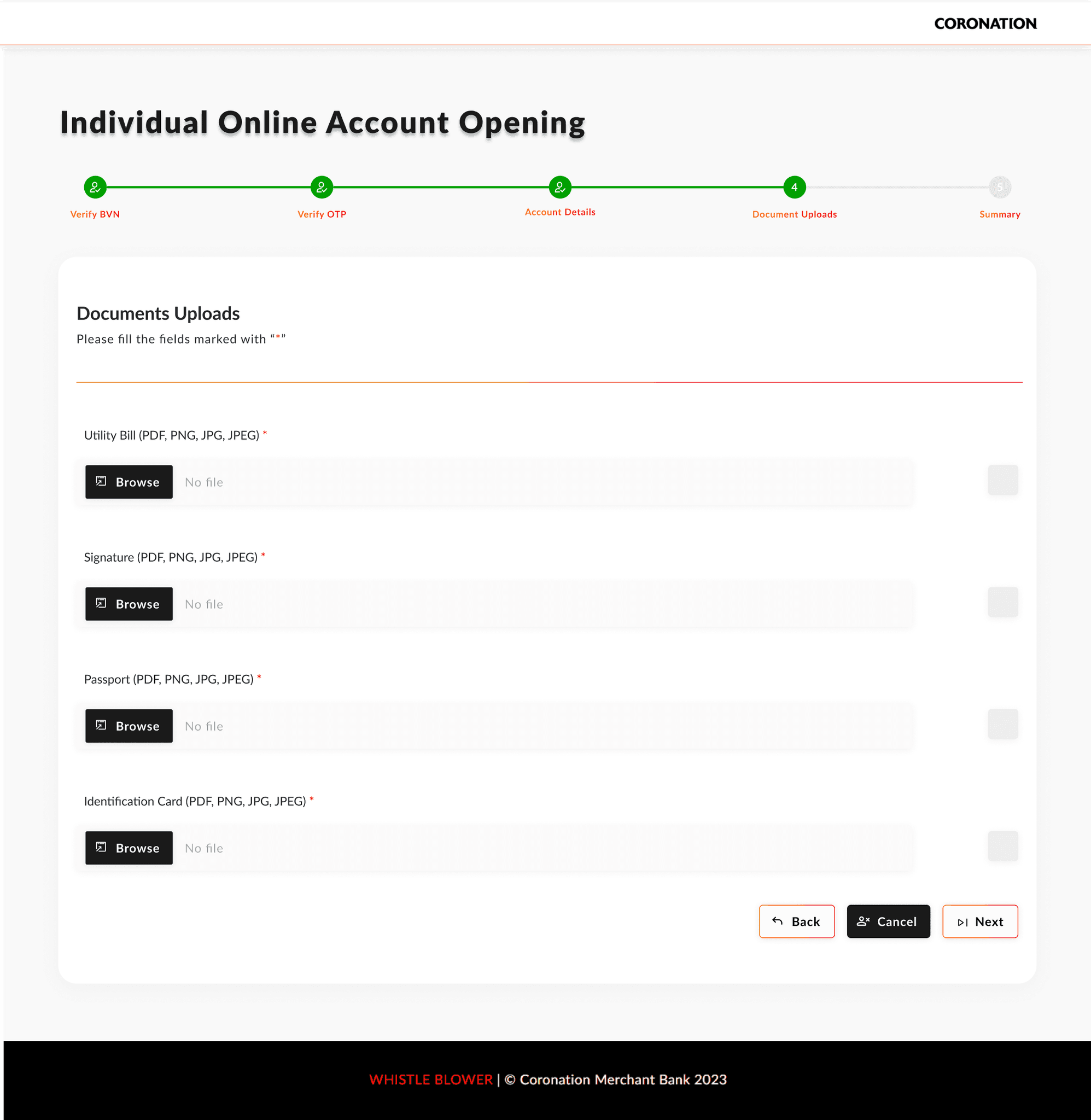

Customers could fill in their details, upload necessary documents (such as identification and proof of address), and submit the form online.

Automated KYC and AML Checks

The system would automatically cross-reference customer data with relevant databases to meet regulatory requirements.

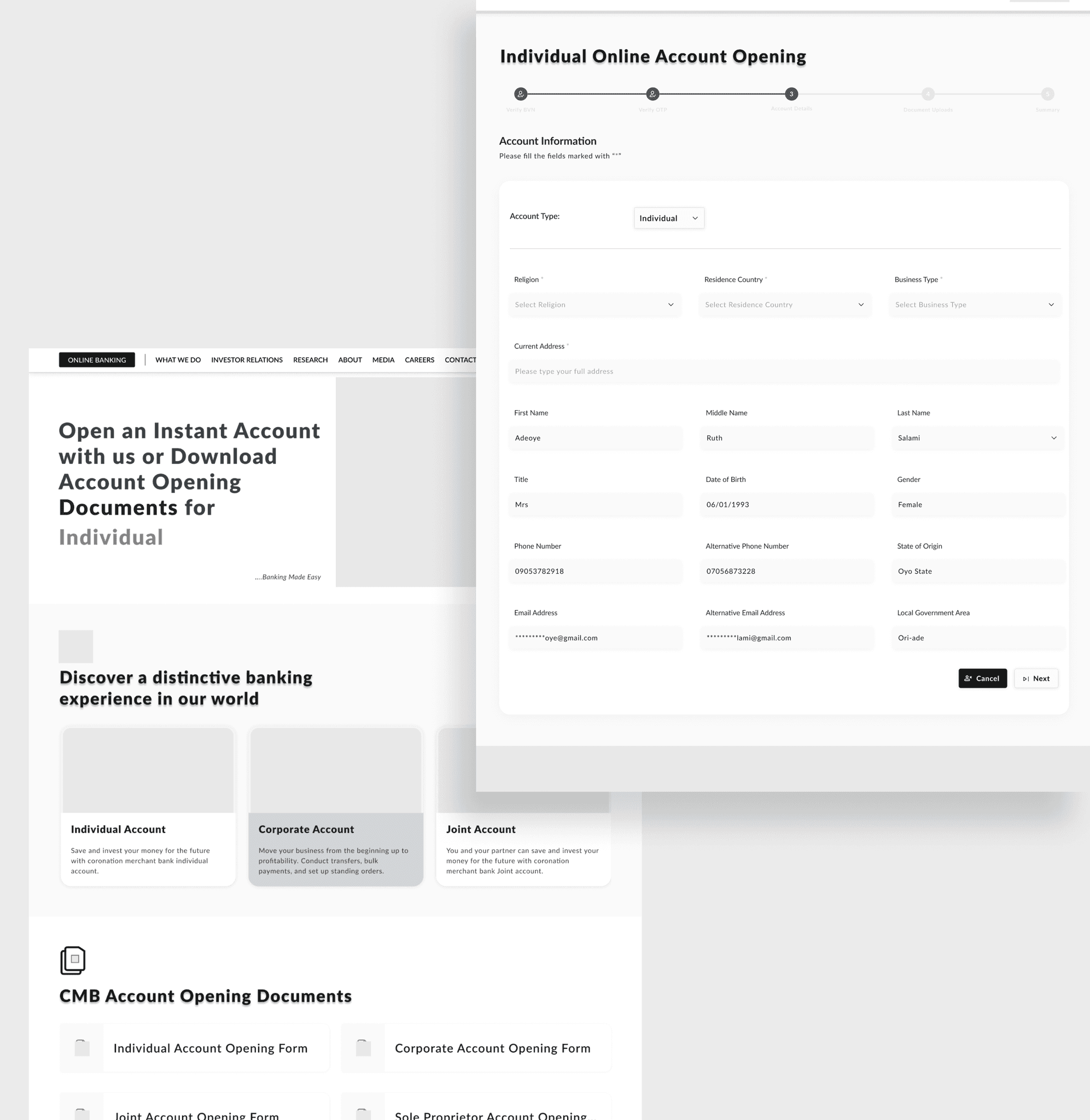

User-Friendly Interface

We designed an intuitive interface that guided users through each step, minimizing confusion and reducing the likelihood of errors.

Secure Data Handling

Data encryption and secure cloud infrastructure were integrated to protect customer information from potential breaches.

We proposed this solution to meet customer expectations for faster onboarding, reduce the workload on bank staff, and ensure compliance with all regulatory standards.

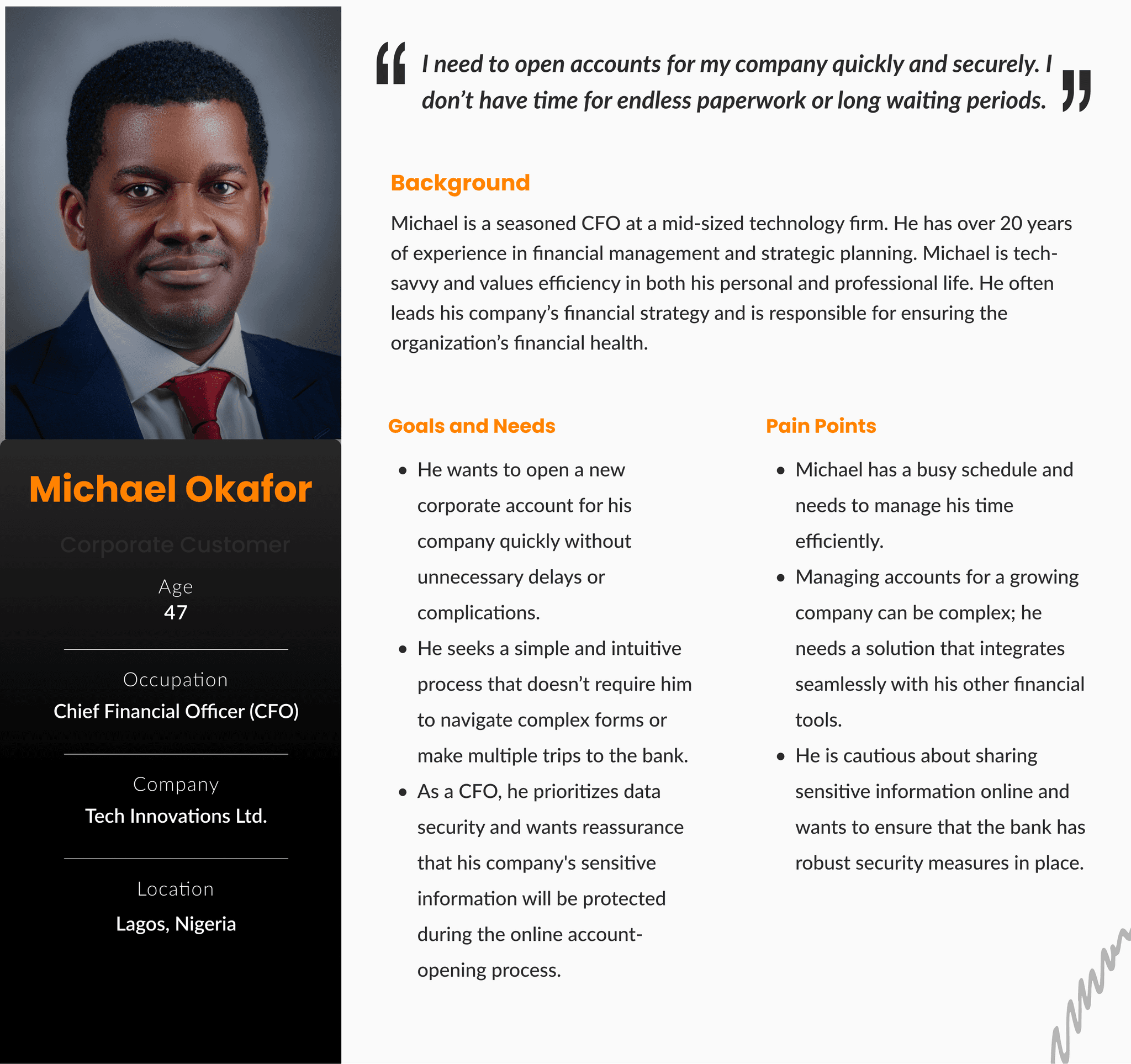

Michael Okafor is our corporate client with a strong need for a quick, efficient, and secure account-opening process. Understanding his persona helps Coronation Merchant Bank tailor its automation efforts to meet the expectations of busy professionals like him, ensuring a smooth onboarding experience that aligns with their operational goals.

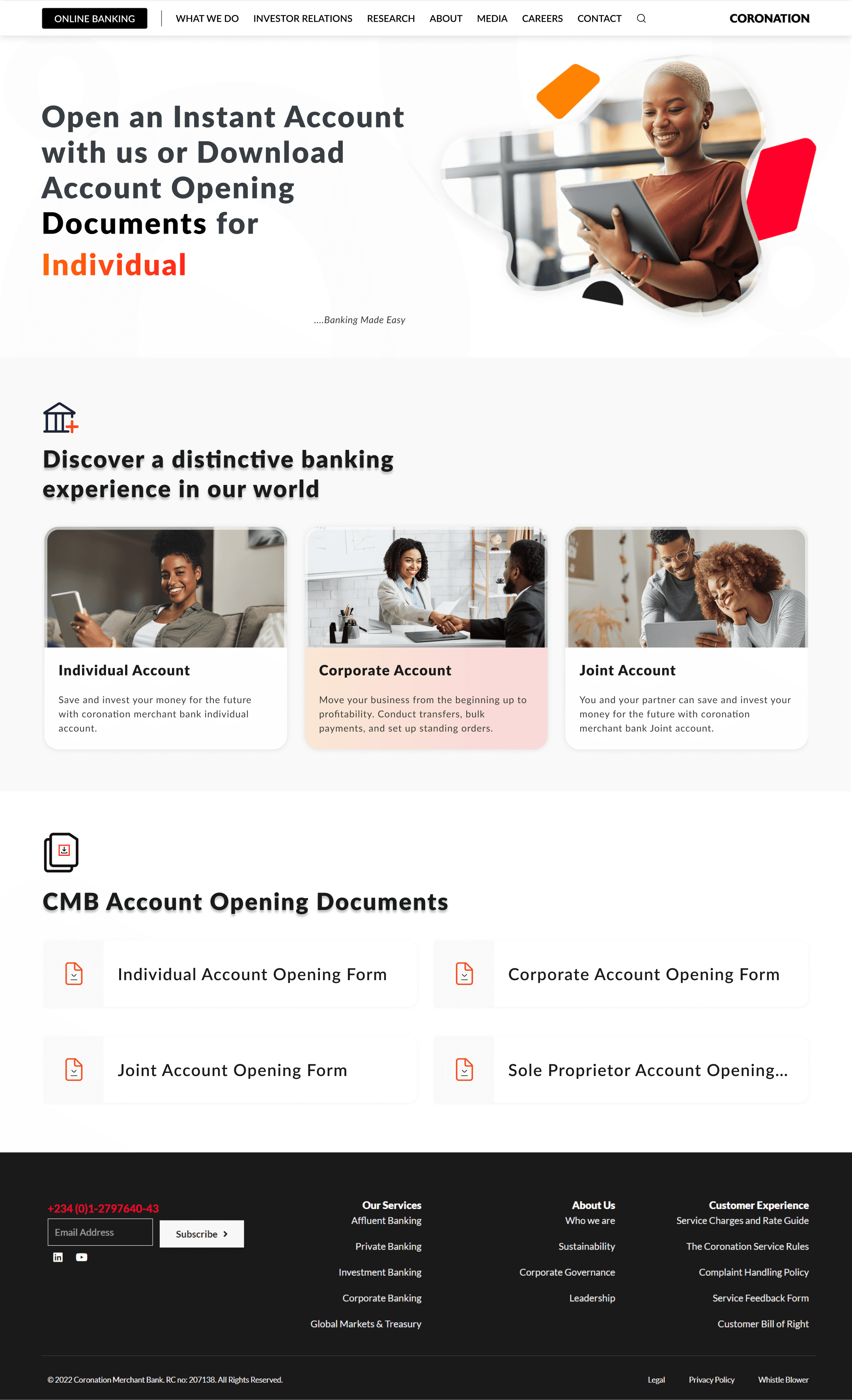

Landing Page

Users can chose to fill the form directly online or download the form to fill manually through CMB corporate website

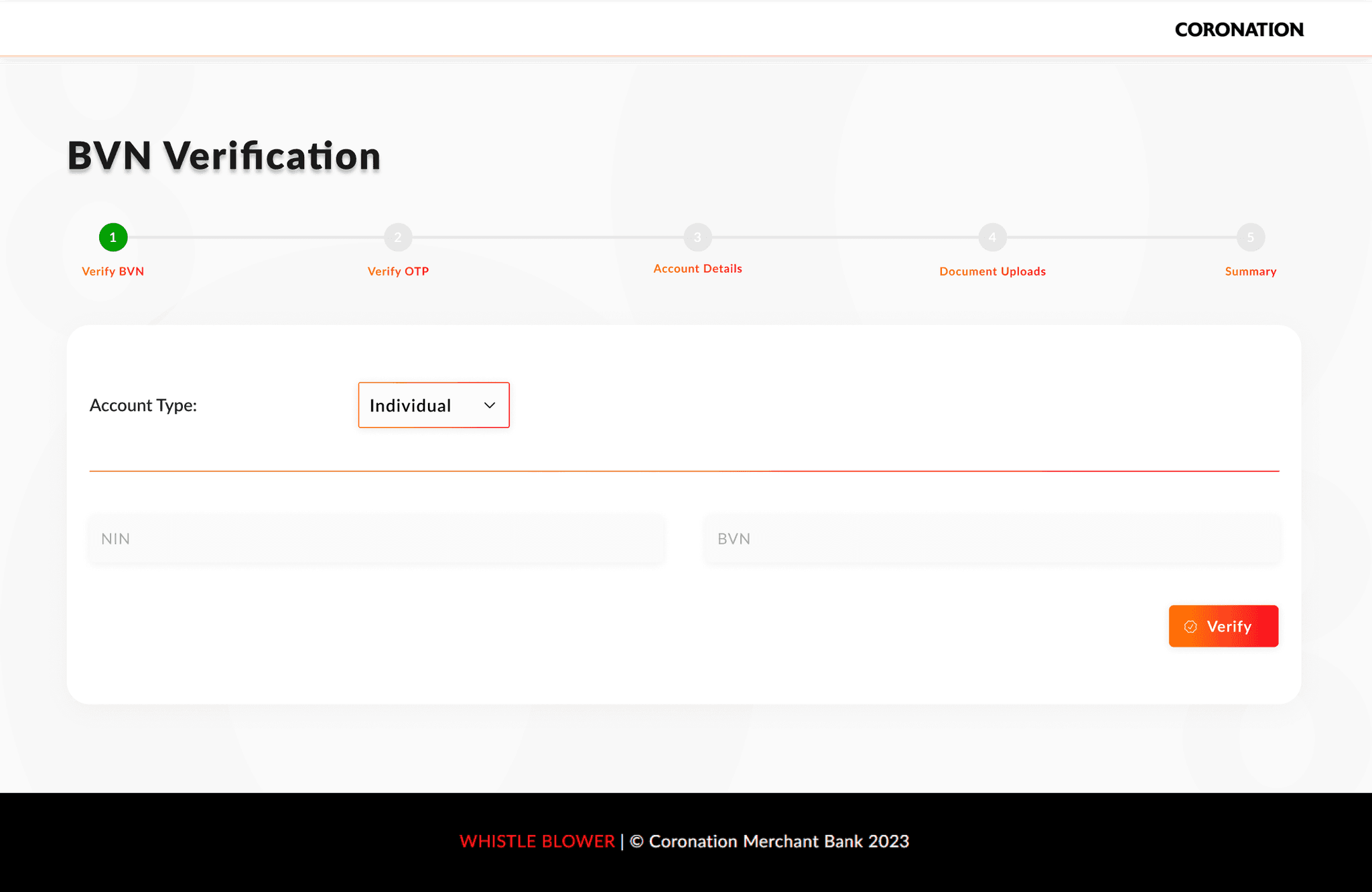

BVN verification screen for Individual Customers

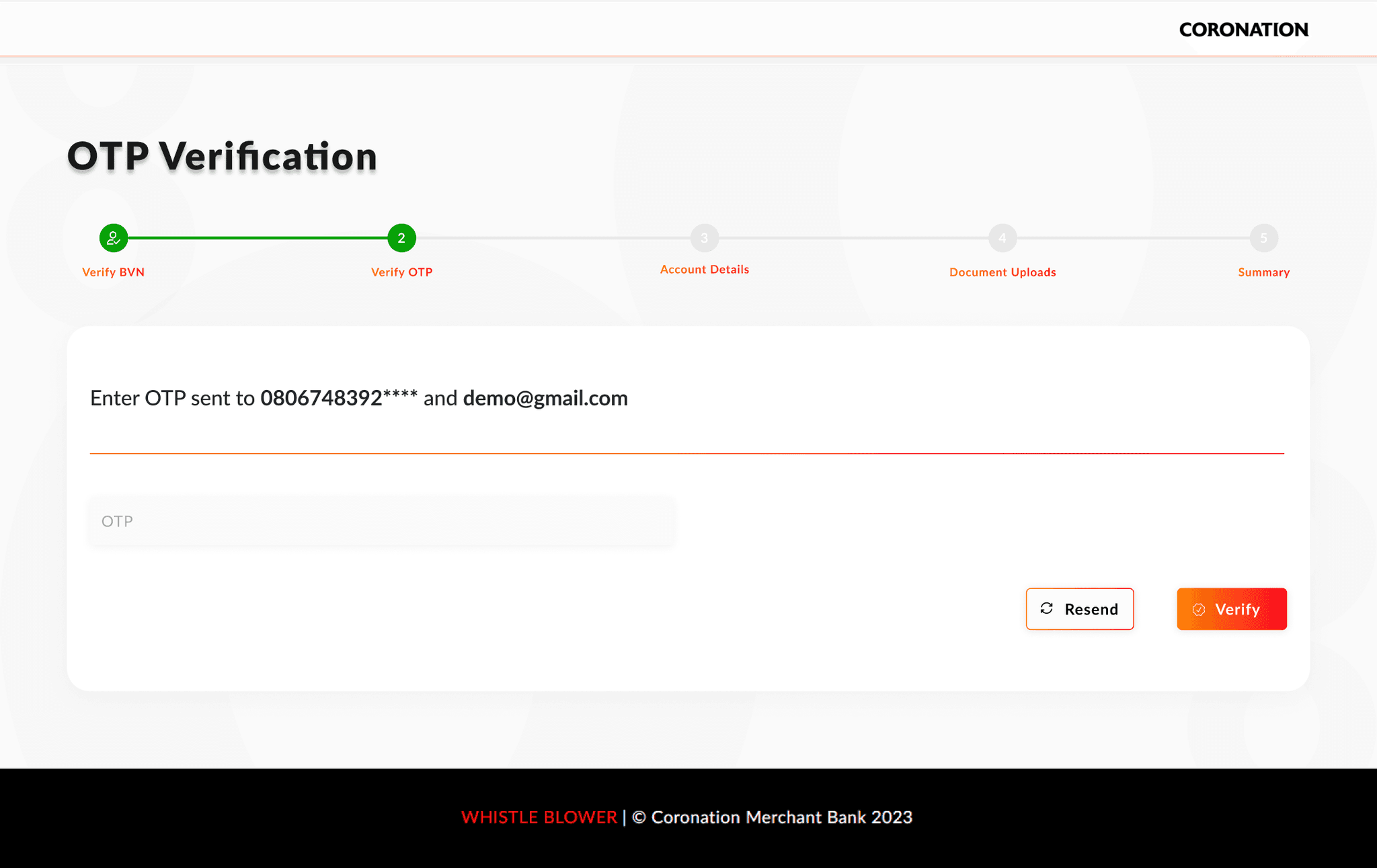

OTP verification screen for Individual Customers

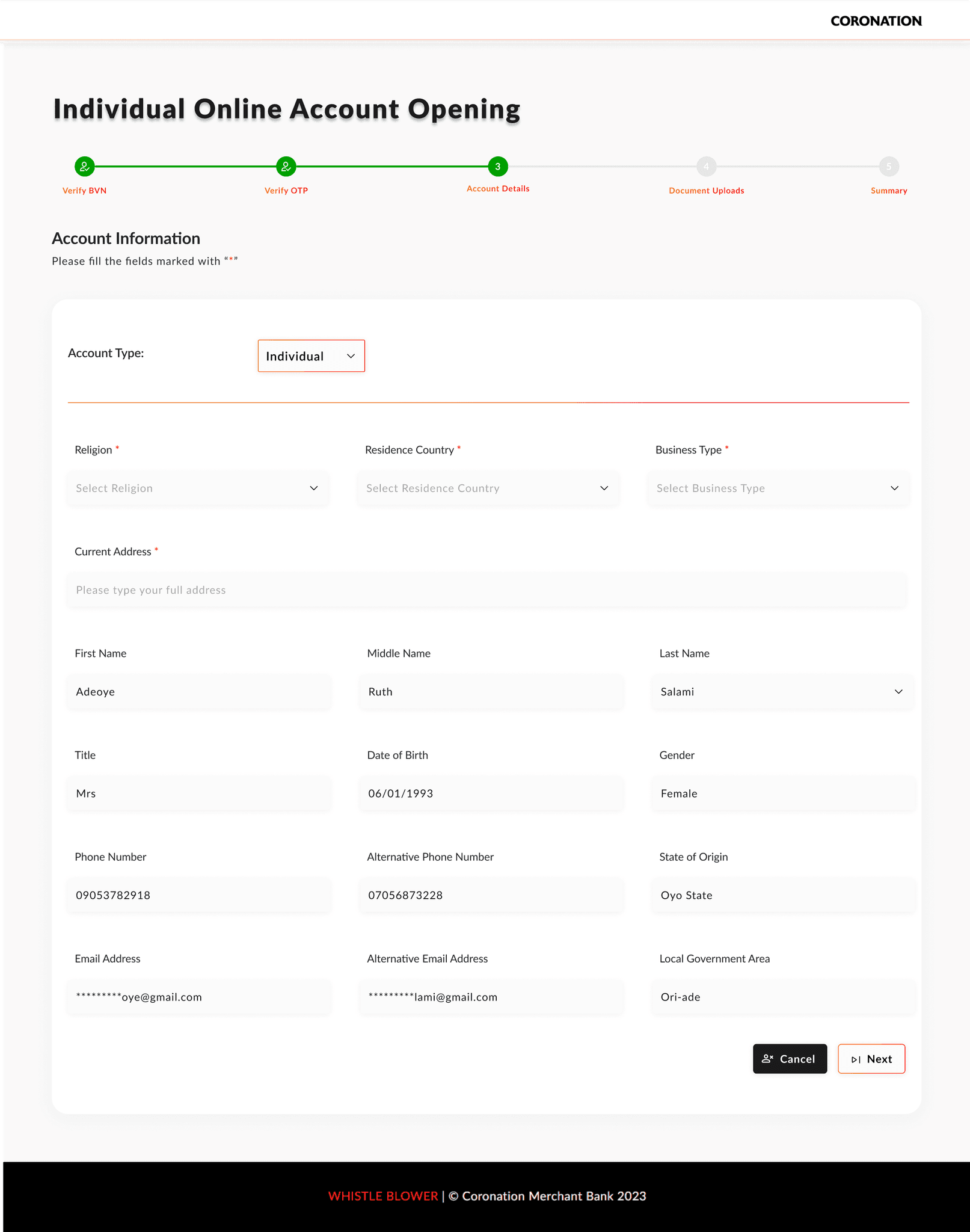

Account details screen for Individual Customers

Document upload screen for Individual Customers

Solution Impact

Usability tests showed that the design and user experience were more intuitive and less overwhelming for users. The key features of final solution includes:

> Users progressed through documentation submission, personal information, and verification in a linear, logical flow.

> Real-time prompts helped users understand what documents were required and how to upload them.

> Integrated real-time ID verification and address validation sped up the process and minimized errors.

> Given the increasing trend of mobile banking, the design was optimized for both desktop and mobile devices.

Success Metrics

35% increase in account opening conversion rates

Feedback and Adjustments

> Customer Feedback: Initial users loved the streamlined experience, but some faced issues with uploading large files or receiving confirmation emails. We addressed these by optimizing file size limits and tweaking email notifications to be faster and more reliable.

> Bank Staff Feedback: Operations and compliance teams appreciated the reduced manual workload but noticed minor discrepancies in KYC data validation, leading to more back-end work than expected. This prompted further refining of the KYC verification process to eliminate false positives.

Challenges

> Some design elements required complex integrations with third-party ID verification services, which led to delays.

> Ensuring the flow met all regulatory and security standards posed constraints on the user interface, such as mandatory fields and documentation checks that couldn't be simplified further.

Impact on Users

> Users experienced faster and more efficient account opening with reduced frustration, contributing to a positive banking experience. They were more likely to complete the process once they started, thanks to the real-time guidance and ability to save progress.

Impact on Business

> Increased account conversions by 35%, contributing to growth in the bank's customer base.

> Reduced workload for bank staff, as the automation eliminated manual data entry and document verification, freeing up resources for higher-value tasks.

Key Takeaways

> Testing prototypes early in the process allowed us to quickly identify user pain points and adjust our designs accordingly. This prevented us from investing development time into ideas that might not work.

> Regular touchpoints with the development team ensured we balanced innovation with feasibility, ensuring we stayed aligned with technical realities.